Registration for the Online Wealth Management Program

I am ready to Build and Protect my long term wealth using the Retirement Plan ฿™ Online Wealth Management Program to protect me from currency wars, real-estate crashes, government failures & stock market crashes using both the traditional, Bitcoin & cryptocurrency markets.

Retirement Plan ฿™ Online Wealth Management Program Dates:

Module 1 - The Retirement Plan ฿™ Financial Ladder

• Module 1, Week 1 training released Monday 3rd April 2023 5pm UTC

• Module 1, Week 1 LIVE Q&A Friday 7th April 2023 5pm UTC

Module 2 - The Retirement Plan ฿™ Investing Principles

• Module 2, Week 2 training released Monday 10th April 2023 5pm UTC

• Module 2, Week 2 LIVE Q&A Friday 14th April 2023 5pm UTC

Module 3 - The Retirement Plan ฿™ Investing Blueprint

• Module 3, Week 3 training released Monday 17th April 2023 5pm UTC

• Module 3, Week 3 LIVE Q&A Friday 21st April 2023 5pm UTC

Module 4 - Maximising Bitcoin & Crypto Growth

• Module 4, Week 4 training released Monday 24th April 2023 5pm UTC

• Module 4, Week 4 LIVE Q&A Friday 28th April 2023 5pm UTC

Module 5 - Maximising Bitcoin & Crypto Income

• Module 5, Week 5 training released Monday 1st May 2023 5pm UTC

• Module 5, Week 5 LIVE Q&A Friday 5th May 2023 5pm UTC

Module 6 - Investor Psychology, Becoming Your Own Bank, Security & Avoiding Scams

• Module 6, Week 6 training released Monday 8th May 2023 5pm UTC

• Module 6, Week 6 LIVE Q&A Friday 12th May 2023 5pm UTC

Module 7 - Tax, Inheritance, Banking & Fiat Off-boarding

• Module 7, Week 7 training released Monday 15th May 2023 5pm UTC

• Module 7, Week 7 LIVE Q&A Friday 19th May 2023 5pm UTC

*Membership site will be available for 24 months from the date of purchase.

Retirement Plan ฿™ is brought to you by the longest standing company in Bitcoin - BnkToTheFuture.com.

Here is what you’ll get…

Retirement Plan ฿™ is an Online Wealth Management Program that gives you everything you need to Build & Protect Your Wealth by investing in Bitcoin and other digital assets, the smart and simplified way, hedged with traditional financial products which have the potential to thrive in any market conditions.

By the end of this program, you will have a complete legal tax strategy, the knowledge and confidence to build a balanced portfolio using time-tested wealth management principles which have been specifically designed to help you Protect and Build Your long-term Wealth.

Who is your trainer?

Simon Dixon, ex-investment banker, early Bitcoin investor, CEO & Co-Founder of Bnk To The Future which is responsible for over $1bn invested in crypto companies, author of the first published book in the world to cover Bitcoin (Bank To The Future: Protect Your Future Before Governments Go Bust) and Angel Investor in many of the largest companies in Bitcoin (Coinbase, Kraken, Bitpay, Robinhood, Bitfinex & over 100 others), guides you step-by-step on how he applies the best of traditional wealth management principles to the new digital currency sector whilst combining it with traditional financial markets.

Simon Dixon shows and implements every step he would take if he were starting to build his wealth from scratch now.

In fact he puts his money where his mouth is - LIVE during the Retirement Plan ฿™ Online Wealth Management Program, exclusively for those who register now…

…Simon Dixon implements the Retirement Plan ฿™ live with a percentage of his salary and $1m of his own savings (don't worry, you can start as small as you like), to empower you to make your own decisions including legal crypto tax structuring, Bitcoin Focused Portfolio Theory, Crypto Asset Allocation, Crypto Friendly Banking and how to think about achieving the right mix of risk and return for your investment goals.

Our goal is to help you:

- Protect your assets and wealth through a Bitcoin Investing 101 Online Wealth Management Program that cuts out all the noise in the current Digital Currency market and does not dismiss the importance of traditional financial markets even if you are completely new to Bitcoin.

- Apply Traditional investing principles to new Digital Assets with a complete Digital Currency Investing Step-by-step Formula even if you lost money in previous crypto bear (falling) markets.

- Give you everything you need to start investing in Crypto with a Complete Guide to Investing in Crypto combined with traditional markets today even if the market crashes or pumps (rises… don’t worry… you’ll get the hang of ALL the lingo throughout the program).

The Retirement Plan ฿™ Online Wealth Management Program is not just an educational program. It’s much more than that. You will learn from Simon Dixon who has over 20 years experience and expertise in building wealth in both Bitcoin and traditional finance, whilst gaining access to his black book of industry insiders who have been there from the very beginning and who have successfully built and protected their wealth in crypto for the long-term. You will work with Simon Dixon in a LIVE online streaming format whilst you watch him start over right from scratch, so you can immediately put what you learn into action for yourself, together. At the same time, you will be joined by a supportive community who will all be doing the same as you, over a committed immersion-style seven-week period.

Here’s what Retirement Plan ฿™ will do for you…

Let us hold your hand so that you can finally get started investing in Bitcoin and alternative Crypto Assets with the perfect balance of traditional financial markets, done in a responsible way, whilst helping you to Build and Protect Your Wealth with our step-by-step Online Wealth Management Program - Retirement Plan ฿™.

It is led by Simon Dixon who also brings in his personal advisors and other industry experts who have achieved complete financial independence through Bitcoin and Equity in crypto companies so you don’t get wrecked in a financial crisis and so you never miss another digital currency bull market again.

By the end of the 7 week Retirement Plan ฿™ Online Wealth Management Program, you will...

- Know how to Build and Protect Your Wealth even if banks go bust, real estate crashes and governments can’t pay their debts by becoming your own bank so you're able to own assets outside of the traditional financial system, move money globally without a bank and protect yourself from inflation, legally, tax compliantly and tax efficiently, so you have less financial anxiety and more financial peace of mind. It’s designed to give you more control of your financial destiny.

- Understand how to add structure to your long term Digital Currency investing plan ฿™ by applying the techniques of professional money managers and family offices using traditional markets so you don’t lose all your capital investing in the many scams, pump and dumps, and Crypto distractions.

- Put into action online wealth management led by Simon Dixon, an ex-investment banking insider and crypto expert that spoke at the very first Bitcoin conference in 2011.

IMPORTANT - Who is this for?

The Retirement Plan ฿™ was designed specifically for you if you fit into one or more of these three main groups:

You're new to Bitcoin and crypto assets and have achieved a good level of success in traditional investing or in your career, but you are now ready to protect, supplement and build your wealth. You want to hedge yourself against inflation and exposure to traditional financial products such as real estate, stocks, bonds, bank deposits and pension plans. You want to hedge because you’ve also seen other well respected traditional investors who are starting to move into this market.

You're comfortable investing in crypto, but have lost money selling too early, overtrading, investing in ultra high risk altcoins, followed unsuccessful investors telling you what to invest in, listened to friends and family, scammers, “crypto gurus”, or simply because you found yourself constantly chasing the next new shiny object in crypto - only to fail miserably in maintaining long term wealth. Finally, you are fully committed and ready to apply long term sustainable investment and wealth management principles that are used by the top 1% of wealth managers and ultra successful investors, to build and protect your long term wealth - tax compliantly, tax efficiently and with a solid structure future proofed to pass onto your loved ones.

You're completely new to investing but driven and ready to learn. You want to build and protect your long term wealth with some of your funds set aside or you have a regular income which you wish to invest a percentage of your money each month to plan for your future. You don’t want to rely 100% on your pension, or don’t even have a retirement plan, but you now want to build and protect your wealth for the long term and get started now.

If that’s you then…

-

Register only if you are fully committed and ready to finally move forward to learn and implement a responsible approach to investing in Bitcoin and other crypto assets using time tested traditional finance principles which are used by the top 1% investors in the world.

-

Only consider joining if you can commit to putting everything you learn into action with a supportive and exclusive online community from the Retirement Plan ฿™.

Join now if you are willing to commit to only 4 hours of online weekly training to execute a time tested and proven methodology over the course of the next 7 weeks. This is all done at the convenience and comfort of your own home, whilst using your Laptop / Desktop / Smartphone / Tablet.

Now that you're ready to join please note...

- Those that have either a regular salary or at least $10,000 of investable funds will get the most out of the program, although the principles apply to any amount of investable capital as long as you have a steady income.

- Residents in the US are welcome to join and all content is available and relevant to both US and non-US residents. Some third-party services (e.g. a crypto currency exchange) discussed in Retirement Plan ฿™ may not take on US customers. Where this is the case we may discuss alternative solutions that are available to US residents if such solutions are available.

- You will need a basic level of technical competence including using the internet, a secure computer and the ability to use online applications and services. You don’t need to be a developer or technical expert, but if you struggle with using services like online banking, downloading apps on a mobile smart phone or receiving SMS pin codes to login, you need this base level of technical competence to get the most out of the program.

You need a minimum of 3 to 5 years to build your Retirement Plan ฿™, if you need to cash out earlier you risk losing the effectiveness of the Retirement Plan ฿™.

If that’s you then here are the 7 modules we will implement together over the 7 weeks after registering...

Module 6 / Week 6

Investor Psychology, Becoming Your Own Bank, Security & Avoiding Scams

Module 1 / Week 1:

The Retirement Plan ฿™ Financial Ladder

In module 1, before you start building your Retirement Plan ฿™, we'll give you our fill-in-the-blank simple spreadsheet. This is used as your map and generates your personal financial plan. It will diagnose your current financial situation and give you an exact amount that is needed to achieve your financial goals so you can choose the right traditional and Bitcoin investing strategy mix to achieve financial independence. This removes all guess work on how much to invest, how much risk to take and what investment strategy to use. Liberate yourself so you know exactly how to achieve your financial goals, no matter how big you dream, even if you are starting with no savings and an average salary.

In module 1 we'll cover:

- The 7 Financial Assumptions that make up the Retirement Plan ฿™ derived by combining the principles of the most successful investors in both the traditional and cryptocurrency markets that allow you to cut out all the noise and financial jargon even if you are completely new to investing.

- The 3 Steps to beating traditional markets so you can finally understand the benefits and risks of traditional financial products such as Stocks, Bonds, Bank Deposits, Fiat Currencies, Real Estate, Commodities, Pension Funds and how they all fit together with Bitcoin and other digital assets. We cut out all the noise and help you feel empowered when listening to financial gurus in both traditional markets and Bitcoin knowing how it all fits together allowing you to avoid being distracted from your long term Retirement Plan ฿™.

- How to climb the 7 rungs of the Financial Ladder to achieve complete long-term financial independence using an investment approach designed to perform in inflation, deflation, economic growth or economic decline or even bank failure using the best of traditional markets and Bitcoin designed to remove financial anxiety and increase financial security as you get closer to retirement age, even if you have not started saving for your retirement yet.

Module 2 / Week 2:

The Retirement Plan ฿™ Investing Principles

In module 2 we go through the investing principles that make up the Retirement Plan ฿™. Using these investment principles we take all the subjective decision making out of your Retirement Plan ฿™ like when to buy, when to sell, what to buy and what to sell, so you can set it up and spend your time doing what you want to do. Make your Retirement Plan ฿™ work for you, rather than you working for your Retirement Plan ฿™. These are the investing principles that allow you to spend your life doing what you want rather than creating another job for yourself managing your investments.

In module 2 we’ll cover:

- How to use 7 time tested traditional investing principles used by the most successful investors in the world to supplement your Bitcoin & Crypto Investing approach to help Build and Protect Your Wealth in the long-term so you don't spend your life looking at prices, panicking at every market crash and trying to buy low and sell high.

- 7 Bitcoin Investing Myths That Stop You Becoming Financially Independent Using Retirement Plan ฿™. As this is a BnkToTheFuture.com product we have the benefit of analysing over 150,000 investors and understanding what made some investors more successful than others. As we were an investor in Bitcoin from the beginning we also know what stopped many investing in the highest performing asset class in history. Don’t let these myths get in the way of you building and protecting your wealth even if you have done very well with your traditional investments.

- The 7 steps that make up The Retirement Plan ฿™ Blueprint Revealed. Let us hold your hand and implement each one step-by-step over 7 weeks with a blueprint and formula that you can tailor to your personal financial plan. Remove all the complexities and frustrations you may have experienced getting started in the past.

Module 3 / Week 3:

The Retirement Plan ฿™ Investing Blueprint

In module 3 you’ll begin to understand the pitfalls, benefits and risks of alternative crypto financial products. You’ll finally know how to use them to supplement your Retirement Plan ฿™ returns whilst fully avoiding blowing up your Bitcoin wealth, by managing risks unshakably like a pro. You'll understand how to cut out all the noise from people that want to sell you opportunities that don't have your best interest in mind. Understand what to pay attention to and what to ignore from the huge myriad of distractions, jargon and noise that will come your way such as Stablecoins, Ethereum, Mining, Staking, Private Equity, Altcoins, ICOs, IEOs, Crypto Lending, Security Tokens, DeFi, NFTs and the list goes on.

In module 3 we’ll cover:

- The Retirement Plan ฿™ Bucket Allocations that allow you to fully separate and not confuse funds for your personal security, traditional market investing, Bitcoin and Crypto Market Investing and money for achieving your financial dreams. Most people combine spending money with investing money and hope they can one day afford all they dream of. Through bucket allocations we’ll show you how you can plan when to buy the things that make life worth living without affecting your investment portfolio and harming your personal financial security. Life inevitably challenges your financial goals, but we don't want you to be the investor that has to sell all their Bitcoin and other investments during a crash to pay their expenses in crisis due to poor money management.

- Retirement Plan ฿™ Bitcoin & Crypto Investing Strategies and how to set your Retirement Plan ฿™ Strategy Mixes. We’ll provide you with the tools and online wealth management program to build your strategy mix using the five Bitcoin & Crypto Investing strategies. We’ll hold your hand to calculate expected returns by entering a few numbers on our spreadsheet (developed by our team of analysts with Simon Dixon). The spreadsheet does all the hard work for you without you so you can see exactly how long you need to achieve your financial goals under different scenarios. Obviously past performance does not equal future returns, but we provide you with all the data to come up with conservative, moderate and historical forecasts to plan your investment goals.

- 5 Retirement Plan ฿™ Risk Portfolios. Understand why Bitcoin is at the centre of the Retirement Plan ฿™ investing strategy and how to avoid all the distractions while maintaining a balanced portfolio combining the five Bitcoin & Crypto Investment strategies that significantly reduce risk, supplement returns/gains and remove the need to find the tops and bottoms of the market and gamble on the ‘next Bitcoin killer’. Time to stop speculating on the crypto markets like amateur traders, and finally focus on building and protecting your long term wealth with our Retirement Plan ฿™ that incorporates risk managed return enhancing strategies using sound investment principles.

Module 4 / Week 4:

Maximising Bitcoin & Crypto Growth

In Module 4 we will show you how to implement the seven time tested traditional investing principles taught in prior modules that are used by the most successful investors in the world to maximise your Bitcoin & Crypto Investing approach. This module was designed to help you Build and Protect Your Bitcoin wealth in the long-term, but still take advantage of asymmetric risk opportunities.

In module 4 we’ll cover:

- The case for Bitcoin, the risks and why it should be the focal point of your Retirement Plan ฿™ strategy using a stock to flow ratio analysis. How to use Retirement Plan ฿™ portfolio rebalancing to increase your Bitcoin position. Learn the strategies that avoid you having to check the price obsessively every day and yet still be empowered to know when to buy and when to sell even if you know nothing about charts and technical analysis.

- The case for private equity, the risks and how to claim your stake in the growth of the entire industry to protect your portfolio even when the crypto markets are crashing or in an extended falling market.

- The case for Ethereum, the risks and how to use it as a Bitcoin portfolio enhancer. When to avoid or take advantage of ultra high-risk growth opportunities and when to use them to enhance your Bitcoin position using a risk-managed approach with products like Security Tokens, Equity, Utility Tokens, ICO, IEO, Trading, DeFi & Leverage.

Module 5 / Week 5:

Maximising Bitcoin & Crypto Income

An Income for life is the end goal for every retirement plan. In this module we share how and when to take counterparty risk to receive income on your Retirement Plan ฿™ using collateralised crypto and equity to be on the right side of speculation. We’ll show you how to manage risk and what risks to protect from as well as an approach for reducing risk as retirement comes closer while taking full advantage of the power of compounded interest to significantly enhance your Retirement Plan ฿™.

In module 5 we’ll cover:

- The case for Bitcoin & crypto income, the risks and how to use it to compound interest and growth. How to receive compounded Bitcoin & Crypto Interest & staking Income through centralised crypto finance and how to manage the risk.

- The case for Stablecoins, the risks & using them to manage currency risks. How to receive compounded Bitcoin & Crypto Interest & Staking Income through decentralised crypto finance and how to manage the risk.

- How to use portfolio rebalancing to increase your compounded income so you don’t get wrecked and take full advantage of the power of compounding to get you closer to your dream bucket in a faster time frame.

Module 6 / Week 6:

Investor Psychology, Becoming Your Own Bank, Security & Avoiding Scams

Once you build your wealth, your focus becomes protecting your wealth. The challenge is protecting your wealth is significantly easier if you start with the end in mind. There are 10 protections that if planned for from the beginning make building and protecting your Retirement Plan ฿™ significantly easier.

In module 6 we’ll cover:

- 7 important Behavioural Finance Principles responsible for wiping out Bitcoin & Crypto wealth and how to avoid them.

- The 7 largest crypto scams & how to protect yourself by analysing the red flags.

- 3 Crypto Security Rules you must implement and how to action them even if you are not a developer or technically gifted. Risk managing ‘Being your own bank’ while using the right mix of crypto custody, the smart way to protect your wealth and plan a multi-generational strategy like the wealthiest family offices in the world.

Module 7 / Week 7:

Tax, Inheritance, Banking & Fiat Off-boarding

When you move your traditional currency into crypto we call that fiat off-boarding. The way you do this or transfer your existing crypto wealth will affect the tax you pay in the future upon retirement or the tax your loved ones pay when they receive it. In our final module we'll show you how to build your Retirement Plan ฿™ tax efficiently, compliantly and legally to give you peace of mind with a setup to pass on your Bitcoin & crypto wealth to protect your family, loved ones or preferred charities. We all know two things are guaranteed - death and taxes so finally we'll show you how to ensure your wealth does not end up in the government's hands if it does not need to be or probate when you pass.

In module 7 we’ll cover:

- How to pay the correct level of crypto tax and avoid tax evasion through long term tax planning and when to engage your tax advisor. Understand the structures of the wealthy and low-cost crypto-friendly setups that don’t cost a fortune.

- Crypto friendly banking and how to use your crypto wealth through bucket allocations without getting your bank shut down like many that don't plan this step.

- Setting up an efficient legal structure and building enough wealth to afford a power accounting, legal and financial advisory team to use the wealth preservation strategies of the top 1% reducing risk as retirement grows closer.

- BONUSES -

Retirement Plan ฿™ Bonus Modules with Subject Matter Experts

Here are the Bonuses all Retirement Plan ฿™ Online Wealth Management Program graduates will get by completing the program.

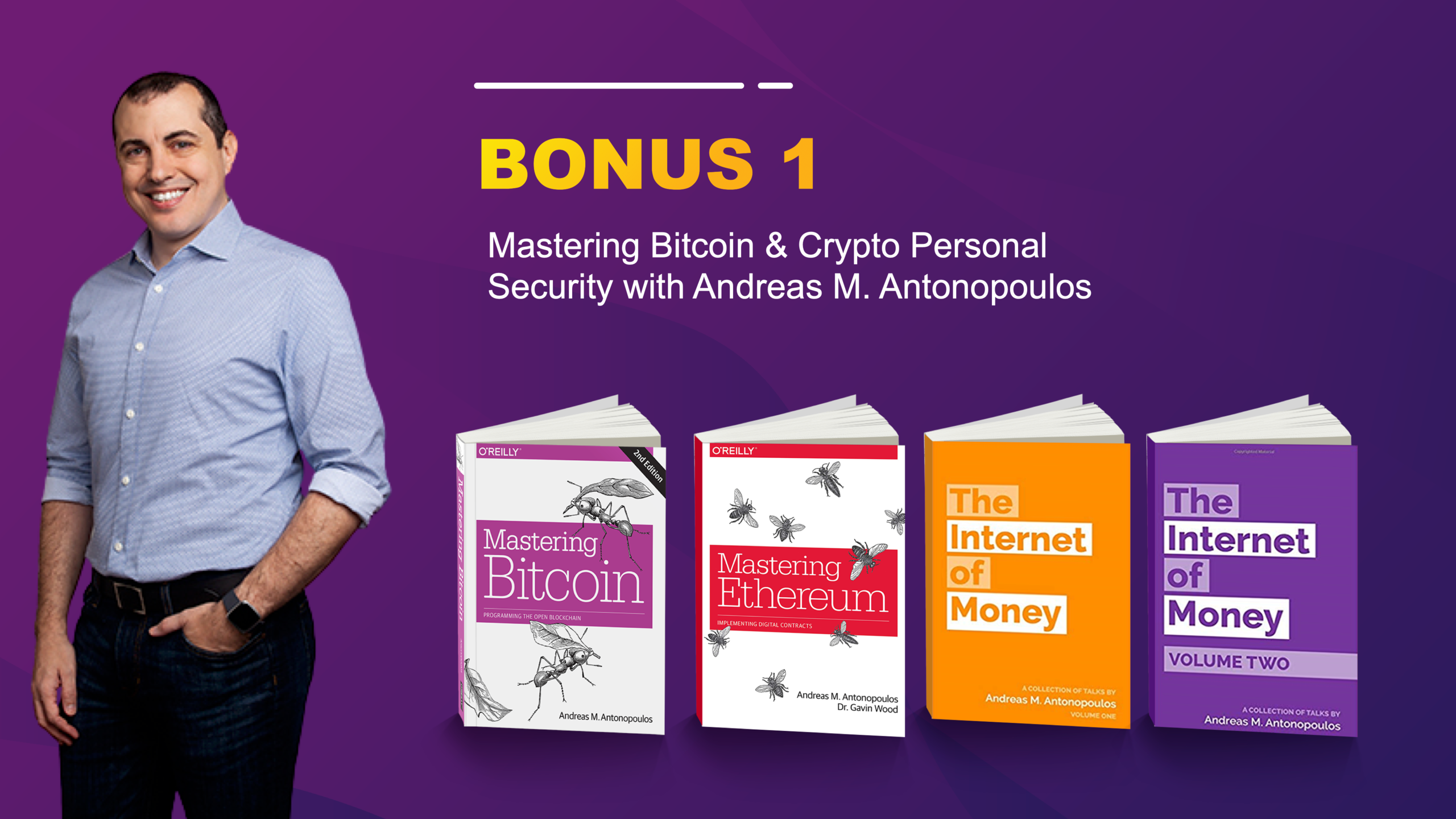

Execution Bonus 1

Implementing Bitcoin & Crypto Security with Andreas M. Antonopoulos, the author of Mastering Bitcoin, Mastering Ethereum and The Internet of Money and my go-to mentor for the security and technical side of Bitcoin.

Execution Bonus 2

Implementing Bitcoin & Crypto Inheritance with Pamela Morgan, the author of Crypto Asset Inheritance and my go-to advisor for inheritance planning.

Execution Bonus 3

Implementing Bitcoin & Crypto Structuring

Execution Bonus 4

Implementing Bitcoin & Crypto Tax Efficiency

Execution Bonus 5

Implementing Automation through Retirement Plan ฿™ Portfolio Builder,

Execution Bonus 6

Implementing Retirement Plan A using the lessons I learnt from in my opinion the greatest traditional investor of all time and author of Principles - Ray Dalio.

Knowledge Bonus 7

Bitcoin Pricing - The Plan ฿™ approach for modelling Bitcoin price using the methodology of the financial analyst whose research helped many in traditional finance make the jump to Bitcoin and finally understand how it compares to other asset classes like Gold.

Refund Policy

If you want to try it out, join us on the first week and if you don’t think it is worth the money we have a no questions asked refund policy. We’ll just remove your access and allocate your spot to somebody else who wants to join us in module 2. If you start accessing Module 2 then you have agreed that you wish to continue and no refund will be available. All refund requests must be received within 14 days after purchase.

Read Reviews & Check Out What Others Are Saying...

You have provided a life boat amidst this maelstrom and chaos.

The Sao C Liu Revocable Trust

I thought the program was very well thought out and definitely gives me a good idea of what I need to do in order to maximize my RPB." Overall, 9 out of 10 from me!

Jordan Seggman

"This is by far the best online coaching program I have ever been in. We can finally be in the driver seat when it comes down to setting up our future and like the saying goes..."Give a man a fish, and you'll feed him for a day. Teach a man to fish, and you've fed him for a lifetime.

Mauricio Rave

Amazing content. Excited to get started! Feel very blessed to be the first group of students to take part in this all encompassing, next level form of investing! Simon is a genius and really enjoyed being a student!

Beverly Diane Brooks

Good and comprehensive overview of where we're at in crypto in 2021 and how to set up an automatic, risk-managed portfolio strategy for your retirement. Well done Simon and team!

Francesco Mosconi

Brilliant course that provides valuable information on planning/investing for your retirement.

Scott McDonald

Excellent - highly recommended.

Roger Price

I really enjoyed it.

Joseph Phillip Swenson

Very helpful for complete beginners. Probably quite a lot of redundancy for more experienced crypto investors. Looking forward to the bonus modules which is where much of the meat appears to lie.

Benjamin Temple Savill & Vy Thanh Nguyen

Simple and Comprehensive without being complex. Measured throughout the 7 week course, allowing you to time to fully digest the information each week. No BS or pump - refreshingly honest. As the first RPB course run - awesome program, which will only get better. Well done to Simon and the team. I'm in and looking forward to the journey.

James Carlton Reid

Simon did a great job of methodically building the foundation of the program and leading everyone to where we needed to get to. The pieces are laid out for us and I'm looking forward to implementing an automated hands-off approach to investing in what I believe to be the opportunity of our lifetime.

Blair Singler

Amazing true and honest program.

Shmuel Soifer

Loved it!

Don Stuart

Very good over view of what to do and can be done. Short on details as to how to actually implement.

Jim Self

A lot of time has been spent put very complex information simply with minimum use of technical jargon, this is no easy feat. The principle are sound and build on top of each other to a logical conclusion.

It 's the only course I had done highlighting repetition and put it into practice.

The Q&A sessions were fantastic, most of my own question were answered in these sessions. The only advise is there is at least 50% of students were non US, but like everything in finance and social media there is a strong US flavour, try to be more inclusive of other countries where possible.Faster pace on most question would be better but Simon answer were excellent and kept on track and a good pace.

Steven Charles Damp

Very Educational!

Piya Petaiprasertku

Excellent program - I've learned a lot.

Tomer Mayara

Excellent course! A great opportunity to go through current finances and to set up a comprehensive investment plan based on a deeper understanding of value, risks and strategies. I have spent a lot of time thinking, planning, tinkering with spreadsheets and dreaming, that in itself has made me more aware, more strategic, and wiser. The course fee initially felt like a stretch, but now I think it was totally worth it! Thank you, Simon and the team!

Cato Grønnerød

This program gives a certainty to those who doubt about investment into Bitcoin. It is comprehensive and builds upon the right values and attitudes we should have about money and our outlook about money. Tools are given for us to be detach, so our focus should be on achieving our two fold purpose in life, which is to develop ourselves and others around us to make this world a better place.

Bernard Tan Boon Keat

Great Program. Great Perspective. Creating a better future!

Louis Coetzee

The RPB course completely exceeded my expectations. I had expected 1-2 hours of weekly content incl. the Q&A. I think it is by far the best value out there. Simon's expertise which he shares so genuinely with his clients has greatly improved my understanding of the entire crypto realm. This is the most comprehensive way of getting your head around all the variables of the crypto space.

Simon

A lot of knowledge to be comprehened.

Somkid Tantirungkij

Loved the content and learned a lot. I must say I expected to see Simon invest in RPB live with all the automation and tax benefits which were mentioned in the pre-sales videos, and for us each to be able to implement our RPB along side him with all the same benefits. We're all hyped up to implement, but can't easily and cheaply gain advantage of all the benefits list in RPB as the mandate is not ready us to use, and we don't have clarity on when this will be and what the costs will be. This was disappointing as a $3,000 investment in the training for some us is considerable and we've finished the core of the training and haven't been able to implement RPB. That said... really looking forward to get signed up for the mandate when it's ready!

Dan Sherwen

My husband and I have enjoyed the RPB course very much and have been following Simon for 3-4 years now. We have been waiting to see what we would do with our Bitcoin and this we believe is the place to be right now. Thanks to all who are participating in RPB and looking forward to other modules and setting up mandate. Thanks again Simon.

Kathleen Delia Santiago

Excellent Value! The course reviews (and confirms) everything that I have learned over the past 5 years and adds significant additional value. It is a comprehensive and organized approach to investing in the quickly evolving Crypto assets and DeFi world.

Jim Gragtmans

Great program, well structured and thought through.

James Andrew Lindsay

Almost (see improvements) everything has been covered and in an excellent manner.

Olivier Bahon

I am a Chartered Accountant, business owner and investor. This is the single best and most beneficial course I have ever been on. Simon you legend :)

Daniel Mclean

Excellent - life changing program which has opened my eyes with a real implementation plan!

Nigel Lloyd Thomas

Investing in crypto from the US and getting a program up and running is a challenge. I hope that by following the steps you have provided, I will be able to move things forward.

Susan Ritholz

Excellent course. Very informative.

Pedram Paul Towfighi, DDS, MS

I'm so glad I found Retirement Plan B. This course taught be so much about the money game that I never thought I would be so excited about investing in my future like I am today. The financial concepts and strategies found inside RPB are priceless.

Gene Morris

Just amazing! Well presented, structured and thoughtful course giving exactly the right balance between education and training for the crypto/fintech investor, whether they be a newbie or professional investor. I am sure the Retirement Plan B course will become the definitive go to resource for crypto/fintech investors worldwide.

Steven Paul Harbour

Great program. Very thorough. Will reward any/all that follow its guidance.

James Robert Merry

Thanks Simon & team, it is so much more than I expected.

Liz Weima

The thought of becoming an investor initially gave me that FUD feeling, so it was a big step committing to seven weeks of studying. The learning modules are clear and concise and professionally put together. Invaluable insights into the psychology/structure and principles of becoming an investor were presented and pleasantly mixed with a healthy dose of positive reassurance from Simon. Modular learning is enhanced with a weekly Q and A with Simon and the RPB team and each module is available for up to two years for future reference if needed. Looking for forward to implementing the mandate and RPB

Many thanks to Simon and his team!

Russell Brian Cooper

Great program.

Guy Laberge

As I have not implemented it yet, I will have to wait. However,I have learned to the best of my ability and implemented each step as they have been revealed. All I can tell you is at this stage I am all fired up, but am a bit overwhelmed with the depositing of the $ 10,000.00 lump sum and the $1000.00 per month Dollar cost averaging.. Fear, uncertainty, doubt (FUD) is constantly at the back of my mind but I know I have been given the best professional guidance possible (not advice) we will have to reconnect at some later date to let you know how this has unfolded.

This I can tell you, is that I recognized from the beginning that Simon really has a great desire to help people, from the bottom of his heart.

Time will tell where this great altruistic dream of Simon's will take financially suffering people.

I truly hope that his dream blankets this newly emerging world in peace and prosperity for all humans.

Much love!

Helen Day

Really great journey I have learned so much about the cyrpto world and investing strategies. Thanks a lot for your initiative and willingness to share with us your knowledge and experience. I beleive that this is the best programme there is on the market and we are so much in advance of the curve now that I hardly believe it!

Really appreciate it that you care about the people and contribute beyond your family and friends circle! I wish you all the best for the future and thanks again! You are a good rich man both spiritually and financially =)

urban KOSTOMAJ

Excellent course combining both the critical importance of asset allocation and the expert insight into building a Bitcoin/crypto portfolio.

John Andrew Kalka

Excellent content that can only come as the result of a lot of experience and years of exposure to the Crypto environment. The comprehensive nature of the course that spans from the basic principals of investing, through psychology and where Crypto is headed was invaluable. This is a complete tool kit to take someone from never having invested to being on the right track... and understanding why they are doing it.

Mark Shaw

Something that 'everyone' needs to complete; life changing information!!!

Ruth Donaldson

Not a good time yet to leave a review as I have so many questions after Mod 7.

Patrick Foley

I have enjoyed it immensely. I will implement it a soon as I possibly can. Thanks to Simon and the entire team!

Sven Oscar Hoier - Hansen

RPB is an excellent program! Thank you Simon Dixon for being so down to earth, honest and generous, sharing your time, knowledge, insights and opinions with us. And thank you to the RPB Community for all your contributions as well! It has all been very worthwhile! This program has set a great foundation for many and is like a beacon of light in these dark times! I look to the future with great anticipation! Thank you again!

James Oakley

Love the content. Well rounded. I have been in crypto since 2017 and I am 100% positive this course is a game changer for me.

Karl Anderson

Just amazing! Well presented, structured and thoughtful course giving exactly the right balance between education and training for the crypto/fintech investor, whether they be a newbie or professional investor. I am sure the Retirement Plan B course will become the definitive go to resource for crypto/fintech investors worldwide.

Steven Paul Harbour

I have learnt a lot!

Jorge Cebrian De Irueta

Well thought out, highly educational, rational and organized. Great outline for redeeming the Time to achieve Financial Freedom Exponentially. Gives me Hope and a way forward. Thank You to Simon and his entire Team!!!

Jacqueline Antonia Tejeda

Wealth of information!

Matt McFarlane

I'm forever grateful to Simon for this program. I went from fear and uncertainty to understanding exactly what I need to do to weather this coming storm and protect my assets. Thank you!

Michelle Lee Salater

I've enjoyed it, but am still digesting my overall thoughts. Too early to share.

Benjamin Mark Sutton

This course is a masterpiece of a masterclass. The structure and information given is very high quality and well stepped through. I am incredibly happy that I took the decision to join. This course is the very key I needed to build my financial platform I always wanted. My lifetime of experience fused with the knowledge, strategy and plan imparted by this course is a fabulous combination. I have experience of legal business structures, crypto, international banking and trading and trusts - I now know how to put the pieces together and complete my plan. Simon has provided me with the missing link and I am awesomely grateful. This course is priceless. Many thanks to all at RPB.

Olivia Ney

Excellent programme which I very much enjoyed. Well worth doing!

Edmund Anthony Severn NELSON

Thank you Simon Dixon, and Team, for all the knowledge provided to me from 2016 and now throught RPB. The Online Coaching Program has clearly given me a way forward to relax and enjoy my remaining years, and hopefully, leave some inheritance to my Family and Others.

John David Barry

Very comprehensive and structured program , that offers an alternative to the traditional financial retirement route but still incorporates the traditional route into the plan. It's a retirement structure that aims to cover all eventualities.

Very well put together considering this is the first time this program has been offered.

There are still aspects of the program content that i feel i need to fully understand but the fact that it is available to me to revisit for a full 24 months is very re-assuring.

Simons delivery of the content is excellent , and he demonstrates complete enthusiasm for the program and to share his high levels of knowledge and experience .

Highly recommended.

Graham Dalton

Great set up and of extremely high quality content.

Luciano Limonta

Almost too much information to absorb but certainly the most comprehensive training imaginable on the whole crypto world.

Graham Rowan

Hands down without any question, the most thorough education on long-term crypto investing and wealth protection I've seen in my life.. and I've gone through many.

Joshua Heffern

Superb content. Well explained. Lived up to expectations & delivered a great plan which I will recommend highly to others. Thank you so much Simon.

Penelope Parkes

Amazing new world opens up, head still spinning but determined to follow through with the implementation!

Erik Weijers

I really appreciate all the work you and your team have been doing for the last 10 years to share with others and help other people to get into the crypto space. Your background and experience in the finance sector is impressive and helpful.

I do share your point of view of the worlds current economic situation and the importance of protecting our own wealth. I am also really looking forward to join the structure that bnktothefuture is implementing with all the things that I have learnt from Retirement Plan B. The content was fantastic.

Jose Maria Fonseca Gonzalez

The best investment that I have done with regards to crypto investing.

Hanguang Fu

Great program, thoroughly enjoyed it, crystalized all my previous knowledge on BTC, Crypto and taking the long term approach.

Matthew Charles Timothy Milner

Great program, comprehensive and well-presented

Andrew Rudman

After taking this program, It's quite evident that Simon has invested himself into this program. The level of commitment from the whole RPB team is clear. There was a lot of effort and content passed on to us and I am truly greatful to have been part of this.

Fairuz Rozich

This is a great program!

Jennifer Yeh

This program addresses my needs well. It is comprehensive and thorough.

Brian Craig Beatty

Extremely good!

Daniel Keenan

AMAZING ! so much content and so much variety of subjects, finally providing security on one's future - THANK YOU ! Simon

Mr. Pankaj Rach

Awesome so far, the implantation will be the real tell.

Greg Anderson

Highly educational and worth every penny!

Charlotte Inzinger Herczeg

RPB is the most enlightening, mature and wholistic approach to investing in the new digital economy sensibly and tax effectively.

Robin Yalden Philip

I have really enjoyed the journey over the last seven weeks, its flown by... Cant wait to start compounding.

Darren Carter

An Intensive program and very helpful for us all who are taking control over our financial future.

Diana Latorre

Really comprehensive introduction to crypto and financial planning.

Andrew McMullan

An amazing Coaching Program.

Leon Engelbrecht

Great introduction to crypto and information on how to protect your future.

Christopher Stuart

Great course, very clear on the logic of setting this up and why it is needed.

John Andrew Herbert Farmer

I feel this is an excellent program that delivers knowledge with a understandable, efficient, workable plan in order for one to move forward in this crypto environment which can be very difficult to navigate by oneself.

I consider the currency spent on this coarse to be the absolute best investment, equal to my BTC / ETH purchases. Without the knowledge that this program delivers one will most likely and can very easily make moves that will extract heavy cost from your crypto portfolio through taxation, missed growth opportunities through compounding, and engaging in areas that are heavily promoted as positive for financial accumulation yet statistics overwhelming prove otherwise.

Knowledge is power, yes. Knowledge is also comfort because one identifies his or her environment and then can implement action towards a desired outcome.

Thank you to Mr. Simon Dixon & the entire RPB team.

Tim Adams

V good. Heavy for a busy person.

Albert Francis Vardy

The program was excellent with an easy to follow format. It's a complex subject which Simon broke down into bite sized pieces and followed up with a Q and A to answer any queries. It has clarified my thinking on how to best plan my finances and I am looking forward to the next stage.

Mrs Eileen Bartlett

A well organized program very beneficial for Noobs.

Scott Manhart

I thought it wonderfully edifying and enthralling. The modules built logically and were compiled in easy to digest incremental chunks that mercifully saved from the expected overwhelm. The weekly Q&A served as a necessary and much appreciated handhold through the complex world of international finance. Good stuff.

Jason Antony Olive

Simon with his entire RPB Team has gone beyond the call of duty to educate and guide people globally. I feel so much peace and confidence knowing, that RPB has equipped me with the best tools to survive this historic global financial turbulence that many people fear.

Carmen Lafrance - Gouin

Great job, Simon.

Mun-Yee NG

Quite simply the best training programme I’ve ever been on. Structured, insightful, detailed yet pointed and direct in providing ‘short cuts’ to the simplified options available. Worth considerably more than the price of admission.

Anthony Goodwin

I thoroughly enjoyed the program, it was well structured, full of informative content delivered with financial integrity and hopefully it will benefit me and my family financially after implementing the strategies learnt. It was also personable and I really enjoyed Simon sharing his own journey and insight with us.

Charlotte Louise Smith

The program gave me so much information in regards to build wealth and change my thinking toward what's important, beginning with how money works and how to grow. But, at the end of the day, it's not rocket science—it's discipline, correct thinking, and separating emotion from action. I can't wait to go through it again!

Mark Horlbeck

10 of 10

Wesley Wosinski

Excellent, thorough and concise content from start to finish.

Tom Watkinson

Very comprehensive. My hesitancy of paying so much for the course is already paying dividends.

Mujibul Islam

It is fantastic.

Georgi Panchovski

Thanks for this great, unique and eye-opening content.

Matthieu Jacquier

Amazing ! Spreadsheets & content are excellent ! Simon gave practical & relevant info on how to get started in RPB. Now starts the hardest journey, many including myself need help in moving into mandate efficiently& properly.

I wish this course was given prior to me investing all my available funds into BF equity, BTC, ETH . Now i have to figure out how to get into mandate with the least tax burden.

Thank You Simon, with the opportunity you have given me to increase my wealth I will surely pay it forward. Looking forward to share my wealth to the most needy in your name.

Uzma Abbas

Excellent learning tool!

Surendra Man Shrestha

Excellent course. Very informative.

Pedram Paul Towfighi, DDS, MS

This is the good diversified education l have been looking for. Totall game changer. Thank you.

Grant Dempsey

So far so good.

David Allen

I enjoyed the course a lot and learned quiet a bet new things.Thank you.

Stefano Morini

I am very satisfied with the program. I struggled a bit in the first few weeks due to a stay in hospital but I have tried hard to catch up and will go over every module again at least one more time. I feel very lucky to be a part of this first set of students and really look forward to carrying out a thoughtful financial plan. I am 79 years old but am determined to hand over to my sons not only a worthwhile inheritance but also much of the financial planning knowledge you have given me.

Fred Pickwick

Nice job..... very helpful.

Charles Polson

Fantastically thorough. Well organized and detailed. Everything one could ask for in an alternative retirement plan. Well done.

Brandon Michael Majewski

This has been the most comprehensive eye-opening financial program I have ever done. I feel extremely blessed to be a part of this and cannot wait to have everything set up and correctly Implement my retirement plan B. Thank you Simon.

Sean P Inman

Fantastic program ! Really mind blowing.

Adam Swirski

I've been extremely impressed with the quality of the content and how well Simon explains the steps required to climb to the top of the financial ladder. This has got to be the best $2,999 investment I've ever made. Thank you.

Martin Langlois

What an awesome program! Such important subject matter, delivered with really well structured and digestible content. The learning curve can be steep, but Simon and Team have really delivered on this proposition and made what is a very aspirational retirement plan achievable and within reach.

Ian McDonnell

Amazing content! my understanding of crypto and defi has grown exponentially

Scott Singer

Amazing. The course far exceeded even my wildest expectations!

Gregory Leonard Axsel

This program is the most life changing information I have ever come across!

Michael Smith

Quality and quantity of the information was excellent and will be a powerful tool in equipping myself to create a life of abundance as I head into the future. Thank you so much Simon, I really enjoyed the balance between the psychological and practical aspects of the wealth management teachings.

Donavan Maree

A unique program that aligns proven financial wisdom to a new asset class- helps you keep your calm and smoothly navigate volatile crypto markets. A Retirement Plan B that everyone ought to have.

Ajay Krishna Gawande

Absolutely hands down, the best investment I have ever encountered in my many years of self education in the realm of finance. The best $3000 I have ever invested aside from BTC.

Carlos Murguia

I enjoyed very much all the program. Because I have very basic knowledge with Crypto, I don't know how to set up a cold wallet and get my own keys from the crypto that I bought in the last years. Not sure if some of this will be coming in the security module.

Antonio Martinez

It's been amazing to learn at such a high level from someone who walks the walk. I am a full time trader and now I dont even want to trade anymore haha! RPB has made me think alot more about my future over short term gains. Incredibly grateful.

Anastacia Snelleksz

Absolutely amazing. The content provided here was second to none that I've found and was done in a straight forward, maximum time/benefit manner which I really appreciated. The course did a great job of making one aware of typical crypto pitfalls and how to avoid them. Simon and the team were also great at listening to the community and implementing helpful changes without catering to every single request. This is a tricky balance that can often times be hard to get right but they nailed it. Hard for me to express the full amount of gratitude that I have for Simon and his team, but I look forward to sharing my future success as he requested and helping others do the same in the future.

Benjamin Scott Genzman

I learn'd about Simon through Real Vision. Following Bank to the Future and then Retirement Plan B allowed me to understand what is really going on and what needs to be done. I would never have figured this out alone and I am very grateful.

Stephen George Kimber

Loved every part of it. Even though I couldn’t attend any of the Q&A due to my time difference here in Australia, I would log on straight away once I knew the recoding was uploaded. Simon has now truly become my online mentor. His material has been monumental to my journey in the crypto world.

Trevor Davenport

The most comprehensive and amazing program I have ever participated in. Thank you Simon and team. May you forever be blessed.

Kyalo Kibua

There's so much goodness here. Important to watch all videos multiple times to truly understand the content well. (If you do share this, btw, please anonymize without using my name.)

Andy Bhatt

Excellent really enjoyed it. Excellent content!

Ian Rhys Edwards

Amazing true and honest program.

Shmuel Soifer

A lot of information to digest for someone who has little financial or crypto experience. Luckily I have both, but still need to go through the videos again!

Min Wilde

This is a great program with a lot of information. I will be recommending this to my friends and family.

Matthew A Zelinski

Great financial course!

David Andre Fernandez

This is a great program I have seen so far. As a person that got scammed during the ico boom and bitconnect I greatly appreciate, structured professional learning as this program provides. I have worked many overtime hours on my job to be able to be part of this. I am hoping I will be able to to implement the knowledge and turn it into practical action plan.

Peter Volek

I will be catching up a lot of the course later; though i have listened to all Q&A sessions so not appropriate for me to leave a review. From what i do know i am very happy that i did enrol.

Mark Charles Wylie

Very thorough and interesting course.

Mark Baker

A very comprehensive program, taking everybody (novice included) to a level playing field before moving onto the finer details of investing in BTC and ETH - well worth the money!

Lennart Wallgren

A very thorough understanding of this new asset class covering all the main elements of investing in crypto currency. Fabulous content including videos, written material, bonuses and Q & A sessions providing us with the confidence to invest in Crypto currency in a safe way.

Pamela Paria

Excellent!

David Brännvall

Essential learning for the Digital Age. RPB's framework for understanding the past/present/future of finance equips you with the knowledge and resources necessary to become successful when faced with an uncertain future.

Adam Nili

Learned a lot, great content, amazing course!

Freerk Jelsma

Simon...what a brilliant and informative course! I am so grateful to be on this RPB membership learning from all your extensive knowledge and your financial life experiences. This has shone floods of bright light on my clear path to freedom. Thank you, I am so blessed and excited that really now...I can dream and plan for the future with my partner and for my family, loved ones and help many others along the way in these so uncertain times. I am so looking forward to the bonus modules to wrap everything up! Thank you again Simon and maybe...one day I can bear hug you and shake your hand personally. Peace to you! My Best, Erle

Erle Freeman

The RPB course has highlighted all of the mistakes I have made so far with my crypto investing and has shown me how to make a much more tax efficient plan to compound my investments so I can enjoy my future with my family.

Stephen Garner

The course materials were good, the approach to mentoring was excellent, and it was good to connect with other clients. Great Programme, excellent information well thought-out videos.

Mel Perera

A thorough walk through of the complexities involved in doing things the right way in the crypto space.

Andy Reid

There are those of us who need to talk things through, to implement in order to learn.

Academics is great but implementation cements the knowledge. I have never purchased crypto and need to talk with someone about the process. This course has been great. I need more direction. Is this possible?

Jo Efird

Mind blowing and very exciting!

Matthew Gomm

Retirement Plan B and it's lead instructor Simon Dixon is absolutly the very best form of all around cryto and traditional investment training and planning available. It covers all the bases and all of the possible monetary, market and assett opportunities and investment scenarios possible. Which we will all have to face going into the future.

Absolutely the best!

Carlos Murguia

The RP฿™ Online Coaching Program was my first ever financial course and exceeded all my expectations. The extensive content unfolded in a logical way, the videos helped to cement that coursework and the take home spreadsheet will allow me to input hard numbers based on my evolving stages in life. The cost of the course has easily been recouped many times over. Big thanks to all @RP฿™

Colin Coote

I love it. I has far exceeded my expectations

Sven Oscar Hoier - Hansen

Good but one module a week's too fast

Grace Lai

Simon has organized a great deal of information in a modular way, covering beginner to intermediate ~ all in a way that helped me understand where I fit in and what my options were moving forward. I was really impressed with the Live Q&A's where Simon really made himself available to the group to answer whatever we wanted.

Maki Hanawa

Great program! I have an extensive background in accounting and finance, but not investing and crypto. As a began my journey to better understand investing and crypto, this was exactly the type of program I was looking for. It is thoroughly constructed, and is thoroughly executed by Simon. Not only did it provide an introduction to, and explanation of, the crypto industry, it also contained valuable content on so many other relevant topics (traditional investing methodologies, investor psychology, legal structuring, tax strategies, global macro theory, and much more). Well done Simon! I'll be following Simon and anything he is involved with in perpetuity.

Charles Kennimer

Simon has organized a great deal of information in a modular way, covering beginner to intermediate ~ all in a way that helped me understand where I fit in and what my options were moving forward. I was really impressed with the Live Q&A's where Simon really made himself available to the group to answer whatever we wanted.

Maki Hanawa

Really grateful to have come across this program. It is comprehensive, thorough and great value for money. Only wish it had existed sooner! Thanks so much to Simon, Bliss and the rest of the RPB and BnkToTheFuture team.

Shailen Jasani

Top draw - Simons' course has given me a clear understanding of the type of investor I am and provided a solid foundation for future decision making in finance - exactly what was needed - well worth the investment!

Arron Gledhill

Retirement Plan B has given me a level of insight into investing into the crypto markets the smart way, I would never have achieved alone. Logical, step by step modules that are explained in an easy way along with an enthusiastic and friendly community. Simon Dixon has shown me just how bright our future can be within the bitcoin community, outside the rigged banking system.

Richard Flanagan

Excellent program!

Teri Miglin

10 of 10!

Wesley Wosinski

Loved it.. Just desperate to get started..! happy to give more info if required.

Matt Edbrooke

This has been an excellent program with regard to encompassing both fundamental financial education and crypto investing in a succinct yet comprehensive manner. I do feel this is sufficient room for improvement with regard to fostering correct implementation and step-by-step guidance.

Brandon Lee

Extremely profound advice to build and secure wealth and transform it into the coming emerging new financial order.

Ralf Denkman

The course certainly accelerated my understanding of the crypto world. My wife and I took the course together so it served to level set our knowledge as well. Self-help guru's like Tony Robins tend to turn me off, so I could have done without all that. I own some BTC and I found the security bonus module really valuable as there are some improvements that I can make there.

Peter Agnew

Prefer not to have my name on it. Great course, learned so much. Already paid for itself 3x over.

Anonymous

Very detailed with everything you need to know explained in easy to manage and understand sections.

Lee Taylor

Valuable to both newcomers and professionals, this incredibly effective bootcamp helps you get your financial bearings in your head, understand the markets and explains how latest blockchain innovations help you on your journey towards achieving both growth and security.

Julius Hudec

Very good.

Lisa Lang

Very interesting program and looking forward to be part of the mandate structure.

Gijs Hamming

RPB has been the most efficient way of learning about Crypto investing. I have saved easily 500 hours of self-study by participating this program.

Pooya Saketi

8/10

Alan Peter Googan

Absolutely hands down, the best investment coaching program I have ever encountered in my many years of self education in the realm of finance. The best $3000 I have ever invested aside from BTC.

Carlos Murguia

Happy to share, still overwhelmed by everything thou.

Peter Volek

Mind blowing and very exciting!

Matthew Gomm

Spot on! It's cool. Great!

Arron Gledhill

It has being an unbelievable experience from the very beginning, the professionalism from Simon, his awareness about the financial system and his experience really helps to bring a level of comfort and trust specially when dealing with finance and money.

Jose David Ramirez

The course has been brilliant , for me the last modules are of the most benefit. Thank you Simon and team you have put together a great product.

Errol Mehmet

No Review for now, I'm still assimilating all of Simon's coaching since there was an issue with my subscriptions which was approved late as my wire transfer to BnkToTheFuture was not posted by your bank.

Jean Luc Botte

The program has been great. Myself and my wife are working our way through the modules and building our RPB.. the education has been fantastic. I revisit the modules frequently and am still getting to grips with the entire structure.

Dinny Collins

Really amazing! I learnt many things I didn't fully understand before and with the option of going back to review it is awesome!

Karen Leach

I feel confident about about my approach to properly structure my financial planning thanks to this course. I learned basic fundamentals with a healthy dose of common sense built on great foundation of time spent on knowledge of history of finance and Its institutions past & present. Being prepared armed with right set of principles and values to prepare me to be on the right side of constant change climbing the financial ladder.

Robert Faletolu

I think some of the modules were a bit wordy/repetitive. I found that if I skipped through in 15 second increments and then listened to the summary at the end of each module, I felt comfortable with the information.

Andre Guillaume

The program is very informative.

Youngmi Jin

I have been blown away by the wealth of knowledge Simon and the RPB have shared. It is such a well rounded program founded on relevant to our current times and with the aim future proofing as much as possible. It goes deep into the fundamentals and practicalities of setting an investment blueprint to follow, and shows the power of compounding, having crypto assets we would invest in, do the work with lending ad staking for instance taking advantage of the power of compounding.

Covering the protection of assets, security, tax and inheritance were very important topics to cover, which are now less scary and seem more manageable some of us who are challenged with lack of experience in this area. I also loved the module where we explored bigger human/spiritual picture, and having an opportunity to understand more about ourselves of why we are doing this.

Thank you so much to Simon and the for this world class program and may it go from strength to strength.

Looking forward to continuing the journey to implement the mandate and what it successfully GROW.

Kim Taylor-Pillay

Excellent program. There is a wealth of information jam packed into this course. It's well worth $3,000.

Lisa Paige Connolly

Very thought-provoking, shedding light into the very nuanced areas of wealth management which most people don't understand or take for granted.

Nadim Karam

Ill review at the end.

Zeljko Cickovic

RPB will save you endless hours of staring at the internet looking for a holistic answer to your retirement plans and still not being sure. It is a plan by the practitioners for the masses! It provides enough on concepts to feel confidant and detailed enough to implement. Pity I am old and broke (but happy to know what I missed! :)

Ebrahim Shaghouei

Fantastic! Takes all aspects of investing for retirement into consideration.

Theis Madsen

High Level Valued Coaching for us normal folks.

Jean Luc Botte Curpen

Good explanation of risk and reward of the different investment strategies incl. taxes

Daniela Moebus

The course was fantastic. I learned so much about Bitcoin. The information about bucket allocations and investment strategies was new to me and gave me more peace of mind that other information I've read about investing. Simon is not only extremely knowledgeable, but seems to really care about his customers and contributing to the financial well being of people. I really enjoyed the personal side he shared in the mindset module!

Janet Michelle Coffee

i relay enjoyed the course, i will be going back and watching all the videos again as it was a lot to take in, very worthwhile.

Scott Lawrence

I really enjoyed the course and was a nice refresher in many areas and have been a fan of Simon Dixon since being into Crypto since late 2017.

I am one of those type of people that was listening out for the penny drop and it came very early on as the 'Mandate' and to find out by the end that the 'Mandate' was not there and can't start investing straight away was very misleading and a big disappointment as this is the Key to RPB investing. Also not knowing how much it may cost to access the Mandate if it does get regulatory approval was never answered and would help planning financially to be ready, but I am prepared to be patient and wait for what could be the best investment of my life.

Simeon George

It is an excellent coaching program by the sheer detail involved together with great support and clarity of the presentation.

Ainul Azhar Bin Ainul Jamal

Amazing and thorough coaching program. Enjoying it a lot and leaning many new things every module.

Tomer Segev

The RPB program is extremely helpful, and well done. most appreciated.

Stewart C Glosup

I have enjoyed the course. Learnt lots, still thinking about all I have learnt.

Chris Mollison

Comprehensive effort to cover a very wide range of subject matters associated with investing in general.

TOMAS HAUGHNEY

Great!

Arron Gledhill

The RPB was informative to the extreme, expanded my crypto knowledge base and security awareness far beyond my expectations as a novice to the crypto world and was literally the second best investment I have ever made, the first will be investing in, implementing and following the RPB via the Mandate. Thank you Simon and your team for not only creating a pathway into the world of crypto, but holding our hand through the whole process of climbing the Financial Wealth Ladder.

Nigel Cook

I'm super impressed. You've certainly reprogrammed my brain from being a trader to being an investor. The costs of taxes and the complexities were very well communicated. The legal structure ideas are still a bit overwhelming, but I'm taking in all the data and hope to get to an actual plan that works. As I said above, one idea I had is to have a couple of these for my grandkids, and one for myself.

Brian Hruska

Great program for anyone new to crypto and for those who’ve been involved who are looking to protect their wealth.

Robert Massey

RPB has given me a vast amount of knowledge, thank you!

Colin James Moffatt

Very thorough.

Richard Coughlin

The step by step process and structure of the program guided me, someone starting from 0 understanding of crypto, to having a fundamental grasp of the ins and outs. By no means am I even close to being an expert, but through this experience (and upon reviewing the course time and time again), I firmly believe I will get to that point of deep understanding and mastery of concepts along with implementing the plans to secure my financial future for me and my family.

Jonathan Chung Mizuno

EXCELLENT BEST EDUCATION masters & PHD degree in Money & Finance.

Mr. Pankaj Rach

The quality of information was second to none, and will take some time to digest and action it all but it is great to have all bases covered and specific areas we can return to should we need a refresh in that area. Great bonus content too!

Michele Newport

Excellent!

David Brännvall

The program is well through out and presented in a clear and straight forward manner. Extremely satisfied with the program!!! Awesome product!!!

Jeffery Stephen Kolb

EXCELLENT ! Full of content at highest levels AMAZING education on money, finance, investing best insight in Cryto and much more - THANK YOU

Pankaj

Best Online Investment Coaching Program I have seen from a non-financial person insight. Very detailed professional content which everyone can understand and risks are clearly explained.

Jean Luc Botte Curpen

Good program! A little hard to get a good overview, but quality of the content is good!

Max van der Laan

The course has been incredibly enlightening for me. I was able to work at my own pace and make sure I understood all the concepts before moving on. It's great that we can go back over and over it as much as we need to and I take my hat off to Simon managing to get through the dreaded "Repitition Recap" each week!

Sue Boyes

Brilliant education leaving me with clear road map for investment in crypto and finance for planning future financial independence, totally whilst leaving a legacy.

Erle Freeman

Five stars – I am happy to be part of program it change my mind on crypto investing.

Zeljko Cickovic

10/10. So grateful to have it! Grateful Simon shared all his knowledge & it has really upgraded my skills.

Heide Lambert

I would like to see more visuals of Simon.

Liron Mazor

I truly appreciate the hard work that has gone into making this information accessible to those of us who want to learn.

Dave

Simon does a fantastic job at detailing a step-by-step method to long term investment, retirement and inheritance planning, centered around crypto and Bitcoin in particular. In this really unique program, he grabs you by the hand, starting with fundamentals all the way to methods applied only by the wealthiest, but never looses you on the way. Everything is still customisable and you can adapt the program to your own situation, wherever you live in the world. Simon is also supported by top-notch experts in their respective fields giving invaluable advice. If you get a chance to subscribe, don't hesitate, it's worth every penny.

Ron Tudju

It's a little too early, but love what I've learned. I didn't even know I needed to know some of the stuff I learned (growth driven). I love having a plan!

Jason Gordon